At Periscope Financial, we understand that financial success is not just a math equation, but a happiness derived from financial goals and dreams being realized. Our commitment extends beyond optimizing financial portfolios; it encompasses a steadfast dedication to delivering personalized, high-quality service. We believe in cultivating connections with our clients, understanding their unique aspirations, and tailoring strategies that align with their goals. We aim to alleviate the burden of stress from financial decision-making, so our clients can focus on enjoying life.

Financial Planning Process

We believe in a comprehensive approach to financial planning, building a strong foundation based on trust and open communication. We aim to establish a long-term relationship that allows us to guide you through life’s financial complexities, ensuring your plan remains aligned with your evolving needs and maximizing your potential for success.

Our Investment Process

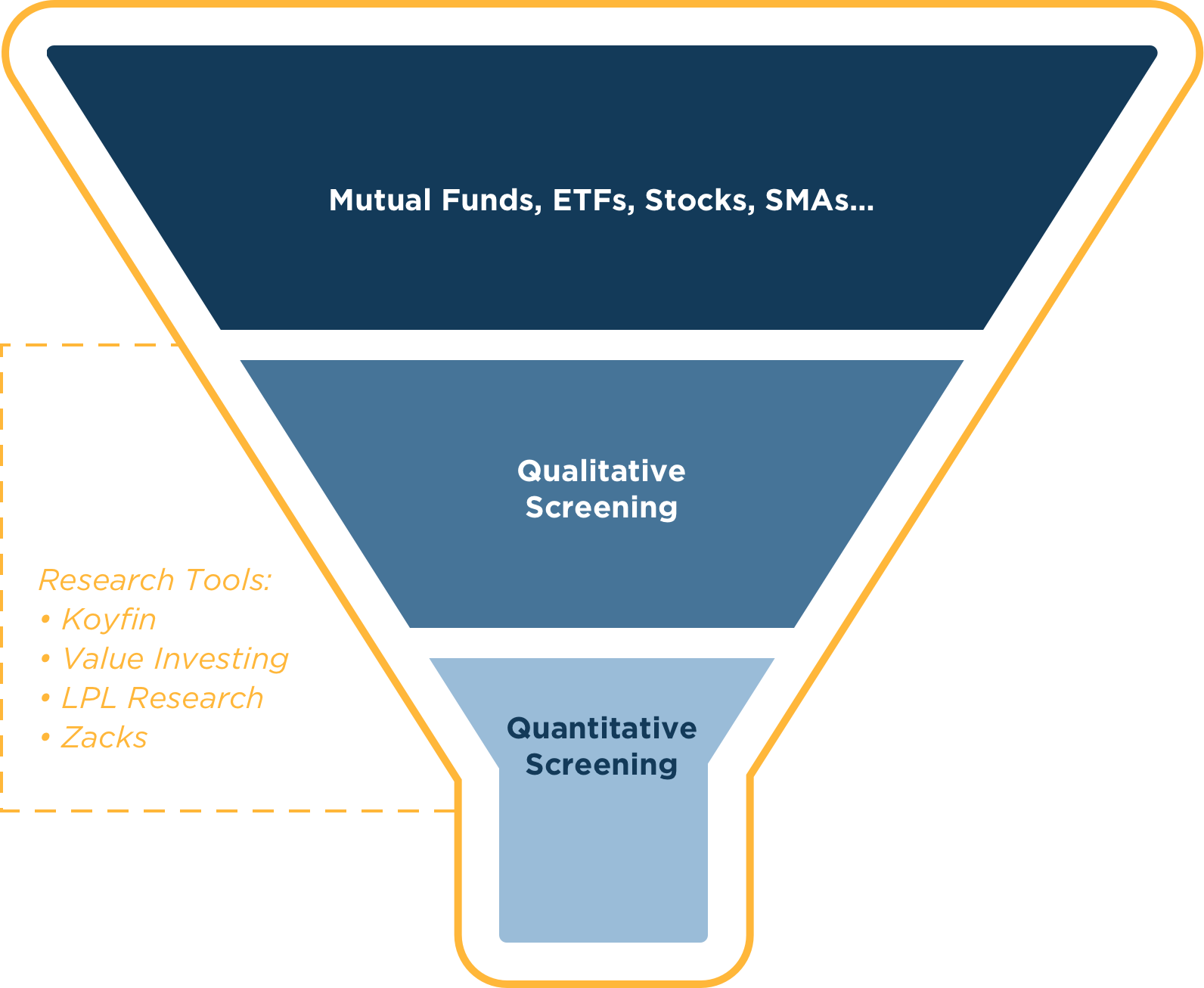

Our process combines thorough research with a broad universe of investment options, tailored to each client’s risk profile. We strategically and tactically allocate assets to optimize returns while managing risk, ensuring our clients’ portfolios are positioned for long-term growth and stability.

Available Investment Universe

Risk Tolerance

Tactical Allocation

Protection Strategies

We also provide protection strategies that secure your financial security, ensuring peace of mind for you and your loved ones.

Insurance

Insurance

Care

Guiding Principles

When it comes to managing your finances, we believe that while modern technology tools are useful, there are unique advantages to having a personal touch in our advisory services that truly benefit you:

- Personalization: We use technology to analyze data, but it’s our ability to understand your specific goals, values, and circumstances that allows us to tailor advice precisely to your needs.

- Emotional Intelligence: Financial decisions can be emotional, and we’re here to provide support during turbulent times or major life events, guiding you through tough decisions.

- Complex Situations: Financial scenarios often involve more than just numbers. Our expertise enables us to navigate legal, ethical, or family-related elements alongside the financial aspects.